Friday, August 31, 2007

Singularity is Near

IBM is in the beginning stages of demonstrating "how to perform certain computer functions on single atoms and molecules, a discovery that could someday lead to processors the size of a speck of dust." "In a second report, researchers...said they had used an individual molecule as an electric switch that could potentially replace the transistors used in modern chips." However, the technologies are at least 10 years away from integration (funny; ten years ago I was on a Compaq computer w/ 33mhz processor). Fascinating stuff. The Singularity is Near!

Thursday, August 30, 2007

I saw a commercial today hosted by Chevron (CVX). The gist of it being that the world is running out of oil and their hoping us consumers will participate in the consumption of their newest alternative energy ventures. I checked out the website they were plugging and it should be checked out. While I was there (according to their counter) there were approximately 3.8 million barrels of oil consumed. I found it interesting that an oil company is putting out commercials that are now warning us all that the wells are running dry. Check out the site.

Tuesday, August 28, 2007

Well, the main trades I was watching today all gapped down (along with the rest of the market). Most provided decent shorting opportunities (even for late entries), and a couple of them provided good reversal set-ups once they exhausted themselves. One stock I was watching (NOV) gapped down and tanked in the morning, but had a very quick price acceleration from noon until about 1:45, where it filled the morning gap (which then provided resistance). The price was parabolic on the 15-minute time frame, but had a more gradual appearance on the 3-minute, so I'm not entirely certain if it could be technically classified as a "SS Short Scalp."

Monday, August 27, 2007

The Future

In a way, this is what our country is investing in. The U.S. could compete if it weren't for the pesky people's rights in this country. I think I'm going to go read 1984 again, just to be reminded of what to expect. Here's to the growth of "the next superpower" that is China!

What I'm Watching

Stocks I'll be watching this week as potential day trades:

NOV with a little resistance at $121.28. Might provide a good long opportunity with a above average volume break of that pivot point. Otherwise (being that it's on the overextended side), it could set up a short candidate if it's turned away from that $121.28 price range again. You tell me. NVDA is in all-time high territory. It was sold off of it's high later in the day on high volume. We could see some selling tomorrow which could present a good buying opp. or we could see a gap up in the morning which could bring a scalping short set-up.

NVDA is in all-time high territory. It was sold off of it's high later in the day on high volume. We could see some selling tomorrow which could present a good buying opp. or we could see a gap up in the morning which could bring a scalping short set-up.

BCSI is pushing all-time highs as well. Looks as though it likes to for a base before breaking up/down. You can draw some good pivot points too from the 15-min. chart.

BCSI is pushing all-time highs as well. Looks as though it likes to for a base before breaking up/down. You can draw some good pivot points too from the 15-min. chart. DRYS closed at an all-time high today. Wouldn't be surprised to see a test of today's resistance.

DRYS closed at an all-time high today. Wouldn't be surprised to see a test of today's resistance.

Other's I'm watching include; CF, ISRG, OII, PCLN

Other's I'm watching include; CF, ISRG, OII, PCLN

NOV with a little resistance at $121.28. Might provide a good long opportunity with a above average volume break of that pivot point. Otherwise (being that it's on the overextended side), it could set up a short candidate if it's turned away from that $121.28 price range again. You tell me.

NVDA is in all-time high territory. It was sold off of it's high later in the day on high volume. We could see some selling tomorrow which could present a good buying opp. or we could see a gap up in the morning which could bring a scalping short set-up.

NVDA is in all-time high territory. It was sold off of it's high later in the day on high volume. We could see some selling tomorrow which could present a good buying opp. or we could see a gap up in the morning which could bring a scalping short set-up. BCSI is pushing all-time highs as well. Looks as though it likes to for a base before breaking up/down. You can draw some good pivot points too from the 15-min. chart.

BCSI is pushing all-time highs as well. Looks as though it likes to for a base before breaking up/down. You can draw some good pivot points too from the 15-min. chart. DRYS closed at an all-time high today. Wouldn't be surprised to see a test of today's resistance.

DRYS closed at an all-time high today. Wouldn't be surprised to see a test of today's resistance. Other's I'm watching include; CF, ISRG, OII, PCLN

Other's I'm watching include; CF, ISRG, OII, PCLN

swing update

Friday, August 24, 2007

Next Week

I've been away from this blog (and day trading) for a couple of days now, which is just way too long. I'm going to take the weekend to regroup and come back on Monday with a vengeance. We got some bullish moves in the markets today with the DJIA, and Nasdaq closing just barely above their 50 EMA's on some mediocre volume. The Russell2000 index is just above it's 200EMA and fighting to stay above it's 2007 open. I have enjoyed seeing my swing trades in GRMN, HPQ, CRNT, and RS do so well this past week even if I wasn't day trading. It will be exciting to see if the bulls can pull the charts out of their pits and back on track next week. I'll make a concerted effort to get myself back on point and get some relevant posts onto this blog.

Wednesday, August 22, 2007

huh?!?!??

I've heard some horror stories of the way in which China "deals with" Tibetan buddhist, monks, but this takes the cake. Going into effect next month China will institute a ban on all reincarnating without government permission. Of course this is a smoke screen for deterring the Dalai Lama from coming back and wreaking havoc on their compassionate and tolerant nation like he's done for the past 50 years. Now, China will, by law, have the right to choose the next Dalai Lama, and I'm sure he'll be a lot more cooperative than the current one is. I mean, the nerve of this Dalai Lama to run away from his homeland (because China claimed the Tibetan land as their own) and spend the rest of his life teaching compassion and humility (and Tibetan independence from China). It's a good thing the U.S. has such a vested interest in trade with China or they might have been blacklisted as an "axis of evil" like the rogue nation of Cuba has been. Anyway, Way to go China for covering your bases and making laws over the souls of your people!

Tuesday, August 21, 2007

Choppy Day

I haven't written any blogs these past few days for a lack of being online and finding content to share. Today kinda chopped around and contributed to my not feeling very confident in making trades. I have been watching set-ups to for parabolic short set-ups. So, I've been finding set-ups and paper trading them, while keeping the charts in a folder for future reference. Most of the one's I've watched turned out going in my direction. Today there were a number of them that turned against me by going higher. It was a day to take your $0.25 gains while you can. Here are a few of the charts I watched and saved for future reference.

Sunday, August 19, 2007

Quiet Sunday

Not much to report this weekend. The only thing I've come across was this posting on Trader's Narrative that I found posted in MovetheMarkets. I found interesting the following:

"The most recent COT report dovetails with the fund flows data. We are seeing a continuation of the commercials going huge net long and the small speculator going the other way. Whether the futures market or the stock market, the two sides have clearly outlined their positions. There is no doubt where they stand."

"The most recent COT report dovetails with the fund flows data. We are seeing a continuation of the commercials going huge net long and the small speculator going the other way. Whether the futures market or the stock market, the two sides have clearly outlined their positions. There is no doubt where they stand."

Friday, August 17, 2007

1/2-day Friday

An emergency discount rate cut this morning jacked up the markets and provided plenty of parabolic shorting set-ups (like the one below). After the market deflated things were at a stand still, and felt like everyone went home for the weekend. Buyers are just too timid at this point to jump back into the market (especially on a friday) without seeing some upside momentum. All-in-all this week provided some great lessons for how to react to the volatility that was in the market this week. I still have work to do in order to fine tune my tape reading and entry points.

Thursday, August 16, 2007

Volatile Thursday

What a totally crazy day in the markets today. It just gets better every day. The volatility today belonged at Great Adventure. Some big names got a smack down today and the indexes gave back their '07 gains. The DJIA, nearly down to it's '07 open, is currently up 3% on the year after today's close. The S&P500 is up 0.47%, the Nasdaq is up 0.95%, and the Russell2000 is down 2.47% for the year.

I wasn't watching things close enough today to day trade. I did put some swing positions on. Today I bought some HPQ at it's 100-day EMA, I bought some CRNT at it's 50-day EMA, and some GRMN near it's day's low.

I wasn't watching things close enough today to day trade. I did put some swing positions on. Today I bought some HPQ at it's 100-day EMA, I bought some CRNT at it's 50-day EMA, and some GRMN near it's day's low.

Wednesday, August 15, 2007

Target or Walmart?

More Selling

Increased volume today along with late-day selling, par for the course. The S&P500 is under the '07 open and the Nasdaq is 30 points away. Meanwhile the DJIA is on the cusp of falling into February levels. To top it all off, here come the tropical storms. Homebuilder confidence is in the toilet, lowest level since '91. Brazil has been buying up U.S.Treasuries and is holding $93.6 billion worth. While China, "the biggest foreign holder of Treasuries after Japan, sold a net $14.7 billion of U.S. government debt from April through June, the first time the country has sold Treasuries in three straight months since November 2000." Everyone's looking to October already to entice Big Ben to cut the rate.

Meanwhile, no trades for me and I'm getting frustrated. I'm anxious for a trading fix.

Meanwhile, no trades for me and I'm getting frustrated. I'm anxious for a trading fix.

Tuesday, August 14, 2007

Which Way to Go?

Strength in a Weak Market

Monday, August 13, 2007

Out of the Mouth's of Babes

And yet, for some reason, Iraq/Saddam is now "worth" the 3848 (and counting) American lives sacrificed. Need we be reminded that NONE of the 9/11 hijackers were from Iraq? What ever happened to Osama?

Sleeper Monday

Today was a sleeper of a day. The bears waiting for the bulls to make the first move, the bulls waiting for the bears to make a move. Meanwhile, heres an article about the European Central Bank getting involved in the money injection theme. $65 billion in loans into the banking system.

Today was a sleeper of a day. The bears waiting for the bulls to make the first move, the bulls waiting for the bears to make a move. Meanwhile, heres an article about the European Central Bank getting involved in the money injection theme. $65 billion in loans into the banking system.

Sunday, August 12, 2007

Sunday afternoon Hodgepodge

We all thought going into last week was difficult to forecast, this week tensions and uncertainty will be even higher throughout Wall Street. Instead of giving my opinion on it all I'm rummaging through the internets to find some points of view and factoids that pertain to the state of our economy.

- China responded to chatter that they might liquidate their holdings of U.S. Treasuries by saying, "China is a responsible investor in the international capital markets." And if that didn't clear the air, they also said "U.S. dollar assets, including American government bonds, are an important component of China's foreign exchange reserves as the dollar enjoys a major position in the international monetary system based on the large capacity and high liquidity of U.S. financial markets." Don't you just love political spin? ahhh The art of not answering a question.

-More hedge funds are coming forward with a statement of their losses. Goldman Sachs' $8 billion global hedge fund is down 26% year to date, or 40% since July '06. If only they would have just invested in a S&P ETF. Meanwhile, Citigroup (C) is reporting losses of $700 million in credit business.

- Of course we've all heard of the Bernanke cash injection this past week. In order to "calm financial markets" (like calming a hyperactive kid by giving them a bowl of candy). Well, the markets are still nervous (if not more so).

- The NYTimes points out that the Fed. Reserve Cash injection is the largest since Sept. 2001 after the terror attacks. It also cites the situation as Bernanke's "first major financial crisis." The operative words there being "major" and "crisis."

- The Fly on Wallstreet's guest blogger "Woodshedder" has a great posting from Friday regarding playing the losing game of trading, with a fantastic link to an article from the Phantom of the Pits (highly recommended you download and read the linked to article).

- Over at UglyChart there's an interesting post and referral links about Quant. trading and the hedge funds that incorporate them.

- Wall St. Warrior and TickerSense do some chart analysis gearing up for Monday's open, putting a spotlight on the 200-day EMA (for the S&P500) that we're all hoping holds as support.

- With all the tumult in the markets Gold prices (though in the upper range of their price trend) aren't acting inversely to the market movements as expected.

- A stroll down memory lane on Howard Lindzon with a news clip from October '87, and indeed THAT was a "bad day." Also, on the DinosaurTraders blog a clip of a more recent "bad day" and the commentary that the talking head sheeple did to rationalize things.

- China responded to chatter that they might liquidate their holdings of U.S. Treasuries by saying, "China is a responsible investor in the international capital markets." And if that didn't clear the air, they also said "U.S. dollar assets, including American government bonds, are an important component of China's foreign exchange reserves as the dollar enjoys a major position in the international monetary system based on the large capacity and high liquidity of U.S. financial markets." Don't you just love political spin? ahhh The art of not answering a question.

-More hedge funds are coming forward with a statement of their losses. Goldman Sachs' $8 billion global hedge fund is down 26% year to date, or 40% since July '06. If only they would have just invested in a S&P ETF. Meanwhile, Citigroup (C) is reporting losses of $700 million in credit business.

- Of course we've all heard of the Bernanke cash injection this past week. In order to "calm financial markets" (like calming a hyperactive kid by giving them a bowl of candy). Well, the markets are still nervous (if not more so).

- The NYTimes points out that the Fed. Reserve Cash injection is the largest since Sept. 2001 after the terror attacks. It also cites the situation as Bernanke's "first major financial crisis." The operative words there being "major" and "crisis."

- The Fly on Wallstreet's guest blogger "Woodshedder" has a great posting from Friday regarding playing the losing game of trading, with a fantastic link to an article from the Phantom of the Pits (highly recommended you download and read the linked to article).

- Over at UglyChart there's an interesting post and referral links about Quant. trading and the hedge funds that incorporate them.

- Wall St. Warrior and TickerSense do some chart analysis gearing up for Monday's open, putting a spotlight on the 200-day EMA (for the S&P500) that we're all hoping holds as support.

- With all the tumult in the markets Gold prices (though in the upper range of their price trend) aren't acting inversely to the market movements as expected.

- A stroll down memory lane on Howard Lindzon with a news clip from October '87, and indeed THAT was a "bad day." Also, on the DinosaurTraders blog a clip of a more recent "bad day" and the commentary that the talking head sheeple did to rationalize things.

Labels:

just blogging,

links,

market stats,

market view,

Our Economy

Saturday, August 11, 2007

Save those Profits

I now have a goal in life. Actually a goal within a goal. So, my goal is to profit enough in my trading so that I could finally afford that trip into space orbit. "Galactic Suite," the first hotel planned in space, expects to open for business in 2012." And for a pittance of $4million for a three-day stay (not including the tropical island training course). $3billion was fronted to build the hotel pod and they have calculated that there are 40,000 people in the world who could afford to stay at the hotel. So that would be a $160billion profit (before expenses) if they could just twist those 40,000 arms enough to get them to want to take the trip. Well, if they run short on people to go they could always create a reality TV show around it where a bunch of catty degenerates compete to be the one's to take the trip. The advertising dollars for that would have to exceed the $4million dollar costs.

I now have a goal in life. Actually a goal within a goal. So, my goal is to profit enough in my trading so that I could finally afford that trip into space orbit. "Galactic Suite," the first hotel planned in space, expects to open for business in 2012." And for a pittance of $4million for a three-day stay (not including the tropical island training course). $3billion was fronted to build the hotel pod and they have calculated that there are 40,000 people in the world who could afford to stay at the hotel. So that would be a $160billion profit (before expenses) if they could just twist those 40,000 arms enough to get them to want to take the trip. Well, if they run short on people to go they could always create a reality TV show around it where a bunch of catty degenerates compete to be the one's to take the trip. The advertising dollars for that would have to exceed the $4million dollar costs.

Friday, August 10, 2007

Crazy Day

Volatility Friday. Things were just all over the place. Today was parabolic short scalping day in Wallstreak, with many opportunities. Unfortunately I found myself trigger shy and didn't step into too many. On TFX I came in a little on the late side and didn't feel comfortable sitting it out so I got out pretty quickly. A profit's a profit in times like these, though I feel I just got lucky with this one. At least it's helping me to get comfortable with the real-time unfolding of a certain strategy.

Thursday, August 09, 2007

Parabolic Short

Here's a trade I took today that just wouldn't have been possible if not for the folks in Wallstreak (in particular, StreetSmack). These set-ups seem to come across clearer when on a chart with a short time frame (1min, 3min). I'm still learning the ins-and-outs of this set-up (which probably isn't such a good idea to trade a set-up I don't fully grasp), but there's no greater teacher than real-time experience. Besides, I didn't have too much risk on the table. I meant to scale out of the position, but came across some technical difficulties that needed some attention and so just covered all at once. One of the tenets of this trade was to scale into the position as the failure takes effect. So, as you see more red you increase your short position. Maybe next time. For now it's baby-steps for me.

Wednesday, August 08, 2007

Ever Hear of HP?

Hewlett Packard (HPQ), remember them? I feel as though there hasn't been a peep of news from them ever since that spying scandal has been out of the headlines. The company has been trending up since early '05 and is currently pushing the upper boundaries of it's channel. Our last correction brought the stock right into its 50EMA and turned into a great buying opportunity. I'll have to remember HPQ when it comes back into the lower end of it's channel. Unless of course it blows out of the upper range on high volume.

Tuesday, August 07, 2007

Move over Starbucks...

...it's time forGreen Mountain Coffee Roasters. GMCR exploded today on no apparent news, with a gain of over $5 or 18+%, and owning its all-time high. And to think, I nearly bought this name yesterday. I've gotta learn to pull the trigger.  and here's how IBD rates it:

and here's how IBD rates it:

and here's how IBD rates it:

and here's how IBD rates it:

A good amount of money to be had in WYNN today. It traded nearly 9x its average volume today on news that people are gambling more and more. woohoo! The stock exploded on the open, retraced down into its 5EMA, then held a tight pattern (on the 5 minute chart) for quite some time. Once it broke its narrow early morning range it popped up a couple more points for a quick in and out move. It would have been even nicer to then go short after it backed away from the highs of the day.

Monday, August 06, 2007

Waiting to Confirm? Or Buying while it's Cheap?

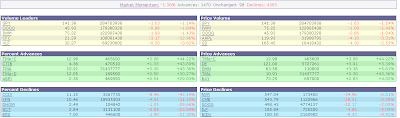

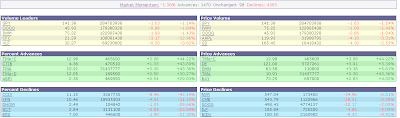

With a strong finish to the beginning of the week chartists are sure to be eyeing their charts looking for a satisfying confirmation signal. Others were probably throwing caution to the wind today and calling a bottom while rushing in to buy last weeks dip while it's still cheap. I have to run at the moment, but will catch up on my blogging tonight and/or throughout the week. For now, here's today's market action:

Saturday, August 04, 2007

Booo-Yaa!

Say what you will about J.C. (Jim Cramer) but he makes for great TV. I found this link to cnbc's video via DinosaurTrader. It's now up on YouTube, thankfully b/c the cnbc version seemed to have playback issues. You think Cramer just lost a lot of money this week and just had to get it off his chest (on national television), or is he just this passionate about people losing their homes?

Friday, August 03, 2007

Investment Firms...

...continue to tank. Just when you think names like GS and LEH are done selling off, well, they just keep selling off. Worst of all looking like BSC, which is approaching 2005 share price level after today's news of its credit-rating outlook was "cut to negative by Standard & Poor's on concern declining prices for mortgage-backed securities will reduce earnings."

Par

Missing in Action

Not having a blog post for one day makes me feel like the invisible man.

Not having a blog post for one day makes me feel like the invisible man.I haven't been trading this choppy market, mostly due to a lack of confidence. So, I figure why not refine my business/trading plan while sitting out of this market melee. There are so many helpful pointers to be had in the Wallstreak chat room. I've been sitting in there while watching the market and picking up some invaluable lessons.

Wednesday, August 01, 2007

Last Minute Buying

Subscribe to:

Posts (Atom)